- Marriot Inns Ltd Financial Analysis (2019-2021)

- Introduction: Financial Performance Analysis of Marriot Inns Ltd: A Three-Year Review

- Aim of the financial information

- Features of good financial information

- The factors that represent the chief characteristics of the financial information

- Evaluation of the financial terminologies

- ROCE

- Asset Turnover ratio

- Net profit margin

- Current ratio

- Acid test ratio

- Debtors collection period

- Gearing ratio

- Labour cost

- Operating costs in terms of sales

- Room Maintenance costs in terms of sales

- Administrative costs in terms of sales

- Analysis and interpretation of the financial performance

Marriot Inns Ltd Financial Analysis (2019-2021)

Are you in need of online assignment help in the UK with a free case study? Look no further than Native Assignment Help. We have a dedicated team of professionals committed to delivering customized support for your academic needs and ensuring you get excellent marks on all your assignments.

Introduction: Financial Performance Analysis of Marriot Inns Ltd: A Three-Year Review

Financial information is a brief report that contains detailed information on the financial activities and performance of organizations. The evaluation of the financial information helps in understanding the overall financial position of the business operations and inflows and outflows of the cash position. It helps the investors make informed decisions with the revelation of financial information and helps them make feasible decisions. The aim of the report is to briefly evaluate the financial performance of Marriot Inns Ltd. The company has recently faced a downturn in its overall financial performance despite increasing turnover. Thus, the company wants to enhance management control within the firm by introducing a system of responsible accounting. The overall analysis of the financial statements has been conducted, which will help in the internal and external analysis of the firm effectively. The actual and future performance is aimed at being strategic with the determination of the financial valuation of the company.

Aim of the financial information

The main objective of financial information is to provide relevant information regarding economic resources and obligations relevant to the business organization. Based on the research work of Lu et al. (2020), the financial statements are prepared by the management of the firm to present the present and historical financial performance of the company. One of the basic objectives of the financial statements is to analyze the financial overview and cash flows that are generated within the organization during the financial year.

These parameters are used for plenty of factors required for economic decisions and meeting the common requirements of the end users of the financial statements. Based on the ideology of risk (2020), the financial statements provide a snapshot of the financial performance of the company at a particular point in time while helping the shareholders to deal wisely. It helps in evaluating the corporate goals of the individual firm and equity investments, particularly when casting votes during corporate matters.

The ratios evaluated help in understanding the overall financial overview of the company in all respects: “profitability, liquidity, gearing, solvency, ROI,” and many more. This helps in understanding the overall wealth condition of the firm and delivers insights into the economic health, risks, and opportunities that provide investors with the opportunity to make sound financial judgments Al Breiki and Nobanee (2019). The overall assessment of the financial performance helps in forecasting and assisting the enterprise model and actual financial objectives, preparing the budget, and discovering the future earnings, cash flows, and expenditures of the firm. Apart from that, stakeholders need to review the financial information, such as the share market power, with the help of a variety of measurements.

As per the reference of Bilan et al. (2019), financial statements are essentially required by the investors as it contain enormous information regarding the company’s revenue, growth, expenses debt, and profitability performance. These are the requirements that are needed for the fulfillment of short-term and long-term obligations. Moreover, the determination of the financial reports offers and records relevant information about the historical and current status of the business that is further used for the economic growth of the business.

Features of good financial information

The qualitative characteristics of the financial information help in evaluating the overall performance of the company and its utility required by investors to make important financial decisions. Based on the views of Ritter and Schanz (2019), investors and creditors have limited resources and thus they seek the scopes where the investments can be maximized and helpful for generating the best possible returns. The feasibility of the financial information helps in capital allocation decision processes. Thus, the missing elements of financial information will lead to inadequate and misallocated capital requirements, which will ultimately affect production and lead to shortages. Higher accuracy in the financial information needs to be provided as it will determine the budgetary goals and metrics (El Haj et al., (2019). The significance of financial performance can deviate from reaching its targeted metrics and objectives successfully. The chief elements of the financial statement include the cash inflows and outflows statement, changes in debt, and equity valuation over yearly trends and periods.

The factors that represent the chief characteristics of the financial information

Figure 1: Characteristics of financial reporting

Relevancy

The information provided in “balance sheet, cash flow, and income statements” needs to be on a timely basis and have a huge potential bearing on predictive and confirmatory value.

Faithful representation

The information needs to be completely true, faithful, free from errors, and neutral as it is used for making future decisions. The faulty information can responsibly affect financial performance and forthcoming performances.

Comparability

The different firms imply different methods of accounting, and thus it is required that the comparison be sufficient for the purpose of valid comparison and interpretation.

Consistency

There needs to be consistency in the methods of the financial outcomes, and the deviations need to be based only on measured outcomes. However, these deviations need to be on the accounting quirks and not on the outcomes of the period from one time to another (Al Rahahleh et al. 2019).

Verifiability

There are different ways and independent observers for the purpose of reaching a similar type of conclusion. Thus, the accounting information needs to be clear and unambiguous for the purpose of preparing the financial information.

Timeliness

The availability of financial information needs to be sufficient, along with sufficient capability to influence financial promotion (Demers et al. 2021). The production of time-to-time financial statements helps in determining the overall positioning of the firm effectively.

Understandability

The financial performance needs to be understandable and easy to interpret, which will help in analyzing the performance outcomes of the company in the fort coming years. Increasing understandability helps in the reasonable business knowledge and decision-making process of the business.

Evaluation of the financial terminologies

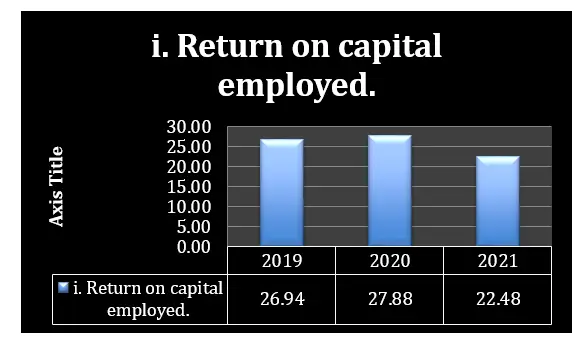

ROCE

Figure 2: ROCE

The computation of the “Return on Capital Employed” with the help of the formula “Operating Profit x 100/Long-Term Loans + Equity” helps in evaluating the total profit that has been generated by the firm with the generation of capital. The increasing ROCE helps in determining that the financial valuation is in stable condition. On the other hand, the decreasing financial valuation indicates that there has been an overall enhancement in the ROCE from 2019 to 2021 by 0.5%. Moreover, the ROCE has lowered compared to 2020, which was 0.87, and in 2021, it is 0.78, indicating a lower ability to generate profit for the firm.

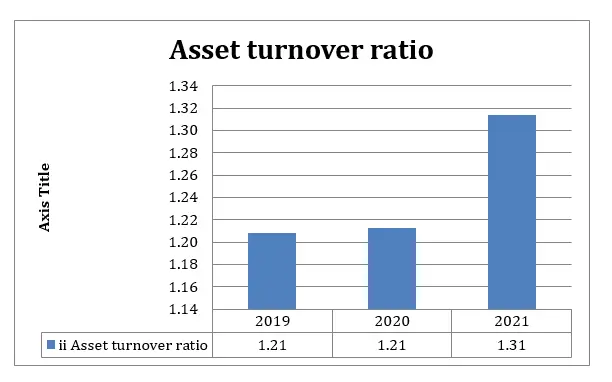

Asset Turnover ratio

Figure 3: Asset Turnover Ratio

The ratio eventually helps in determining the effectiveness of the firm at the time of resource utilization. As per the reference of Louche et al. (2019), the increasing percentage of the ratio indicates that the financial overview of the firm is highly effective. The computation of the ratio has been done with the help of the formula “Net sale/Average total asset”. There has been an increase in the ratio from 1.21 to 1.31, with the net sales increasing from 4.9 million to 6.6 million in 2021 and 2019 respectively.

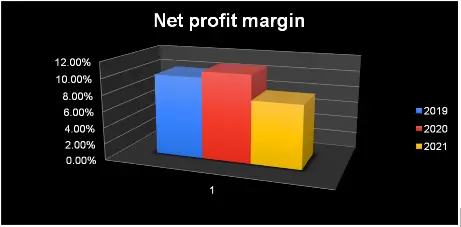

Net profit margin

Figure 4: Net Profit Margin

The overall “Net profit margin” of the firm has been evaluated with the help of the formula “(Net income/net sale) x 100”. Thus, it has been evaluated that there has been a decrease in the ratio from 10% in 2019 to 7.73% in 2021.

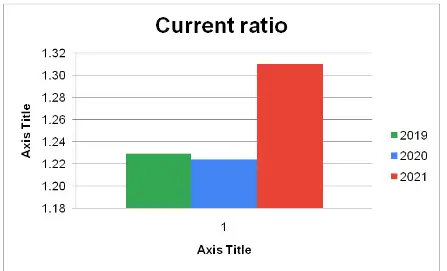

Current ratio

Figure 5: Current Ratio

The “Current ratio,” computed with the help of the formula “current assets divided by current liabilities,” has helped in evaluating the overall liquidity positioning of the firm from 2019-2021. The increasing ratio indicates that the firm is capable of meeting is short-term obligations with enough cash and cash equivalents within the firm.

Acid test ratio

The computation of the “Acid test ratio” is the comparison of the quick assets of the firm with its current liabilities. Based on the research work of Ascani et al. (2021), it helps in the measurement of short-term obligations and the ability to meet short-term commitments. It has been evaluated that the ratio has improved in 2021 to 0.99 by 0.81 in 2019 indicating a higher ability and performance.

Debtors collection period

The “Debtors” collection period” is the evaluation of the period that is required to collect the trade debts. As opined by Husain and Sunardi (2020), the fewer days taken by the firm indicates that there is an increasing ability and efficiency of the company. It is usually seen that the organisation tries to prefer a decreasing “average collection period” that is required for collecting the receivables. The total number of initial days has increased from 83 to 87, which indicates a decreased ability and operational activity.

Gearing ratio

The computation of the “Gearing ratio” indicates the financial vulnerability of the firm and exposed financial risk due to the higher gearing ratio. The ratio has been computed with the help of the formula “total debt/total equity” (Xolmirzaev, 2020). It has been seen that the ratio has decreased from 4.42 in 2019 to 1.75 in 2021, indicating improved financial condition and stability

Labour cost

The labor cost of the firm has been evaluated to be 18.98% consecutively similar for the three years. The ratio evaluates the expenses incurred by the firm for providing employment to the employers. The ratio is helpful in analyzing the cost and expenses of the firm and the changes over the past three years.

Operating costs in terms of sales

The ratio was evaluated at 85.10% in 2019, which has increased in 2021 to 88.19%. This has evaluated the cost expenses required for production purposes and seems to be increasing in 2021.

Room Maintenance costs in terms of sales

The ratio has been computed with the use of the formula Room Maintenance Costs/Total Sales,” indicating the expenses required for the maintenance of the room. It has increased from 8.98% to around 9.24% from 2019-2021.

Administrative costs in terms of sales

The administrative cost in terms of sales has increased over the years from 3.08% to 4.09% in 2021 to 2019. The ratio is evaluated with the help of the formula “total sales by total administrative,” which helps in determining the total administrative cost in terms of sales.

Analysis and interpretation of the financial performance

The preparation of the ratios for the previous three years based on 11 kinds of ratio classes has been done, which will help in determining the performance scale of the company in the future. The overall analysis of the financial performance indicates that the financial performance of the company has decreased in terms of ROCE. The decrease in the valuation indicates that it is comparatively less favorable for the firm. The current ratio indicated that the liquidity positioning of the firm has increased over the years and indicated the capability to pay off the arising short-term obligations and debts. The increasing average debt collection period suggests that the management needs to take proper care of the creditor's history. It has been seen that the NPM of the company has decreased, which can be done with the help of reducing the overall cost and increasing productivity and efficiency.

Are you looking forward to easily navigating through the intricacies of finance assignment help by using Native Assignment Help! Do you want weekly tips for handling financial problems? Our team comprises financial experts who are qualified in this field. Our professionals will help you do your homework so that you can improve your grades and develop a better understanding.

Conclusion

The entire conclusion can be drawn based on the financial performance and analysis of Marriot Inn Ltd for the last three years. The management wants to include strict control over all the operational and financial activities of the firm, which will help in enhancing future outcomes and delivering better financial goals. A vivid discussion of the importance and characteristics of the financial reports has been done in the report. It has been evaluated that the overall performance of the company has slightly improved in terms of turnover, but there have been massive changes and a decrease in the overall positioning. The ROCE of the company has decreased in 2021 from 2019, whereas the Current ratio has increased over the years by 10%. This has indicated that the firm needs to have higher feasibility. The estimation of the financial performance has evaluated the changes in the trends and performance of the company.

References

Al Breiki, M. and Nobanee, H., 2019. The role of financial management in promoting sustainable business practices and development. Available at SSRN 3472404.

Al Rahahleh, N., Ishaq Bhatti, M. and Najuna Misman, F., 2019. Developments in risk management in Islamic finance: A review. Journal of Risk and Financial Management, 12(1), p.37.

Ascani, I., Ciccola, R. and Chiucchi, M.S., 2021. A structured literature review about the role of management accountants in sustainability accounting and reporting. Sustainability, 13(4), p.2357.

Bilan, Y., Brychko, M.M., Buriak, A.V. and Vasylieva, T.A., 2019. Financial, business and trust cycles: the issues of synchronization.

Demers, E., Hendrikse, J., Joos, P. and Lev, B., 2021. ESG did not immunize stocks during the COVID‐19 crisis, but investments in intangible assets did. Journal of Business Finance & Accounting, 48(3-4), pp.433-462.

El‐Haj, M., Rayson, P., Walker, M., Young, S. and Simaki, V., 2019. In search of meaning: Lessons, resources and next steps for computational analysis of financial discourse. Journal of Business Finance & Accounting, 46(3-4), pp.265-306.

Husain, T. and Sunardi, N., 2020. Firm's Value Prediction Based on Profitability Ratios and Dividend Policy. Finance & Economics Review, 2(2), pp.13-26.

Kadim, A., Sunardi, N. and Husain, T., 2020. The modeling firm's value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), pp.859-870.

Louche, C., Busch, T., Crifo, P. and Marcus, A., 2019. Financial markets and the transition to a low-carbon economy: Challenging the dominant logics. Organization & Environment, 32(1), pp.3-17.

Lu, X., Li, K., Xu, H., Wang, F., Zhou, Z. and Zhang, Y., 2020. Fundamentals and business model for resource aggregator of demand response in electricity markets. Energy, 204, p.117885.

Okafor, A., Adeleye, B.N. and Adusei, M., 2021. Corporate social responsibility and financial performance: Evidence from US tech firms. Journal of Cleaner Production, 292, p.126078.

Risk, C.R.I.I., 2020. A fundamental reshaping of finance.

Ritter, M. and Schanz, H., 2019. The sharing economy: A comprehensive business model framework. Journal of cleaner production, 213, pp.320-331.

Wahlen, J.M., Baginski, S.P. and Bradshaw, M., 2022. Financial reporting, financial statement analysis and valuation. Cengage learning.

Xolmirzaev, U.A., 2020. Financial assets and improvements of their analysis. Экономика и социум, (1 (68)), pp.102-105.

Zhou, H., Maneesoonthorn, W.O. and Chen, X.B., 2021. The predictive ability of quarterly financial statements. International Journal of Financial Studies, 9(3), p.50.