Hikma Pharmaceuticals Business Strategy and Competitive Analysis Case Study

This report evaluates Hikma Pharmaceuticals’ strategic position through SWOT analysis, Porter’s Five Forces, and the Resource-Based View, highlighting its strengths in R&D and market presence in over 50 countries.

Ph.D. Experts For Best Assistance

Plagiarism Free Content

AI Free Content

Strategic Position and Market Competitiveness of Hikma Pharmaceuticals

Introduction

The report is made to analyse the business strategy for the strategic direction with the help of data and analyses of theories to create the key strategic and operational performance measures. The report highlighted an international pharmaceutical corporation with its headquarters in London, United Kingdom, is called Hikma Pharmaceuticals. The case company business was established in Jordan in 1978 and has since expanded to become a major international pharmaceutical corporation with operations in more than 50 nations. A wide variety of generic and branded pharmaceutical products, including injectables, oral dosage forms, and oncology therapies, are produced, developed, and marketed by Hikma Pharmaceuticals (Al-Douri, et.al 2022). The company's medications are used to treat a variety of illnesses and conditions, including oncology, pain management, respiratory problems, and cardiovascular disease. Injectables, Generics, and Branded are the three business divisions that make up Hikma Pharmaceuticals. Whereas the Generics category concentrates on the development and marketing of generic pharmaceuticals products, the Injectables segment focuses on the development and manufacturing of injectable medications (Hikma.com, 2023). The Middle East and North Africa area is the primary focus of the Branded segment's development and marketing of branded pharmaceutical goods.

Figure 1: Company Logo

The business is dedicated to enhancing patient health and facilitating access to high-caliber, reasonably priced medications. Hikma Pharmaceuticals has won various honours and commendations for its creativity, commitment to excellence, and dedication to corporate social responsibility.

The Strategic position of the organization

Hikma Pharmaceutical's current strategic position can be analysed by using three theoretical frameworks, which are SWOT analysis, Porter's Five Forces model, and the Resource-Based View (RBV).

SWOT analysis

A common framework for evaluating an organization's strengths, weaknesses, opportunities, and threats is the SWOT analysis. The model helps to assess the internal and external aspects affecting Hikma Pharmaceutical's strategic position .

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

Porter's Five Forces model

Porter's Five Forces model is a framework for analyzing the competitive forces that shape an industry. This model will help to understand the competitive landscape of the pharmaceutical industry and Hikma Pharmaceutical's position within it (Al-Zoubi, et.al 2020).

Threat of new entrants:

- High barriers to entry due to the need for significant R&D investment and regulatory approval.

- Established pharmaceutical companies have economies of scale and strong distribution networks.

- Threat from generic drug manufacturers and bio-similar.

Bargaining power of suppliers:

- Limited bargaining power of suppliers due to the availability of generic drugs.

- Dependence on a few key suppliers for raw materials.

Bargaining power of buyers:

- High bargaining power of buyers due to the availability of substitute drugs and the pressure on pricing.

- Buyers include governments, insurance companies, and consumers.

Threat of substitutes:

- High threat of substitutes due to the availability of generic drugs and bio similar.

- Increasing use of alternative therapies and treatments.

Intensity of competitive rivalry:

- High intensity of competitive rivalry due to the presence of established pharmaceutical companies and the emergence of new entrants.

- Focus on innovation, product development, and pricing (Paksoy, Gunduz and Demir, 2019).

Resource-Based View (RBV)

A theoretical framework known as the "Resource-Based Perspective" places a well-built emphasis on the value of a firm's internal resources and capabilities in creating competitive advantage (Alsawalhah, 2020). This model will help to evaluate Hikma Pharmaceutical's internal resources and capabilities and how they can be leveraged for strategic advantage.

Physical resources:

- Modern manufacturing facilities and production equipment.

- Strong distribution network and logistics capabilities.

- Extensive R&D facilities and intellectual property portfolio.

Human resources:

- Experienced and skilled workforce.

- Robust employee training and development programs.

- Strong leadership team and corporate culture.

Organizational resources:

- Strong brand reputation and customer loyalty.

- Established relationships with key stakeholders, including customers, suppliers, and regulators.

- Robust financial resources and capital reserves.

Innovation resources:

- Strong R&D capabilities and a robust pipeline of new products.

- Investment in digital health technologies and data analytics.

- Focus on niche markets and high-margin products.

Connect with us ASAP and get the same Paper!

Order AI-FREE ContentThe key steps in the development of business strategies

The key steps in developing business strategies for a company like Hikma Pharmaceuticals:

Step 1: Conduct a SWOT analysis

The first measure in developing a business policy is to conduct a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Hikma Pharmaceuticals can evaluate its internal strengths and weaknesses and exterior opportunities and threats to identify areas of improvement and potential growth opportunities (Kolsi, Ananzeh and Awawdeh, 2021). For example, Hikma may have strengths in R&D capabilities and established distribution networks, but may face threats from new regulations or increased competition.

Step 2: Define the company's mission and vision

The next step is to describe the company's operation and visualization. This involves identifying the purpose and goals of the company and creating a clear and inspiring vision of the future. For example, Hikma's mission may be to give high-quality and reasonably priced medicines to patients worldwide, while its vision may be to become a leading global pharmaceutical company (Jandhyala, 2020).

Step 3: Establish strategic goals and objectives

Once the mission and vision are defined, Hikma can establish strategic goals and objectives to achieve them. These goals must be precise, quantifiable, attainable, pertinent, and time-bound. For example, Hikma may aim to launch five new products in the next two years, increase its market share in a specific region, or reduce production costs by 10%.

Step 4: Develop strategies and tactics

Based on the SWOT analysis, mission and vision, and strategic goals, Hikma can develop strategies and tactics to achieve its objectives. These may include expanding into new markets, investing in R&D to develop new products, improving supply chain efficiency, or partnering with other companies to access new technologies or distribution channels (Al and Al Riyals, 2019).

Step 5: Implement and monitor the strategy

The final step is to implement the strategy and monitor its progress. Hikma should frequently review and amend its strategy as necessary to ensure that it remainder pertinent and effectual. Key performance indicators should be established to measure the success of the strategy and ensure that it is aligned with the company's overall mission and vision.

Developing a business strategy for a company like Hikma Pharmaceuticals involves conducting a SWOT analysis, defining the mission and vision, establishing strategic goals and objectives, developing strategies and tactics, and implementing and monitoring the strategy over time (Abdelhadi, et.al 2020).

The critical analysis of the organisation’s current strategic Position

Hikma Pharmaceuticals has a strong strategic position in the pharmaceutical industry, with a diversified portfolio of products and a strong presence in the MENA region, Europe, and the US. The company has a strong R&D capability and a robust pipeline of new products, which positions it for long-term growth and success (Skiadas, 2020). Furthermore, the corporation has a strong financial arrangement, with a healthy balance sheet and cash reserves, providing a buffer against potential economic shocks.

However, Hikma Pharmaceuticals also faces several challenges that could impact its strategic position. The company is heavily reliant on a few key products, which could leave it vulnerable to market changes or regulatory pressures. Additionally, the corporation has imperfect attendance in promising market, which might bound its expansion probable in the long run. The company's manufacturing and distribution network could also benefit from greater diversification to mitigate risks.

In terms of industry analysis, Hikma Pharmaceuticals operates in a highly competitive environment. The threat of new entrants is comparatively low appropriate to the high barriers to entry, but established pharmaceutical companies have significant economy of range and strong distribution networks, making it difficult for new entrants to gain market share. The bargaining power of suppliers is relatively low due to the availability of generic drugs, but the company is dependent on a few key suppliers for raw materials (Desai, 2019). The bargaining power of buyers is high due to the availability of substitute drugs and the pressure on pricing, with buyers including governments, insurance companies, and consumers. The threat of substitutes is high due to the availability of generic drugs and alternative therapies, while the strength of reasonable rivalry is lofty due to the presence of well-known pharmaceutical companies and the emergence of new entrants. Hikma Pharmaceuticals has several internal resources and capabilities that could be leveraged for strategic advantage.

The company has modern manufacturing facilities and production equipment, a strong distribution network and logistics capabilities, and extensive R&D facilities and intellectual property portfolio. Additionally, the company has an experienced and skilled workforce, a robust employee training and development program, and a strong leadership team and corporate culture. The company also has a strong brand reputation and customer loyalty, established relationships with key stakeholders, and robust financial resources and capital reserves. The company's strong R&D capabilities and focus on niche markets and high-margin products position it well for future growth.

The use of data and analysis to make key strategic and operational performance measures

Setting strategic direction and creating key performance measures are important aspects of a company's overall strategy (Adwan, and Al-Hamshari, 2021). Setting strategic direction involves creating a plan for the future of the company.

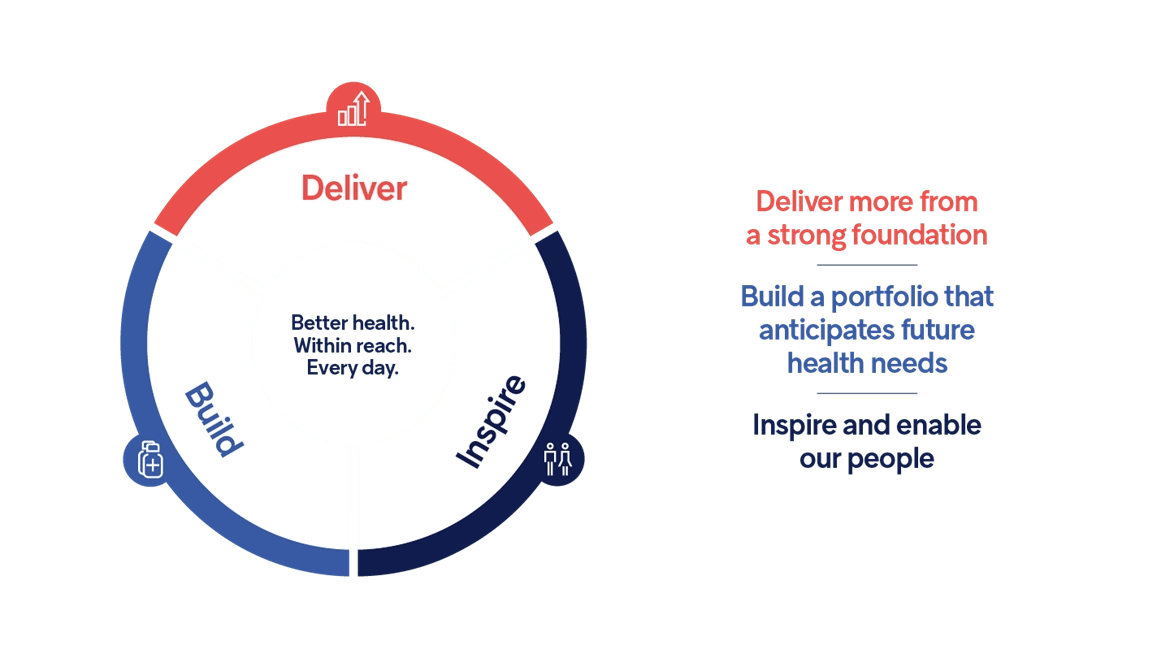

Figure 2: Delivering strategy

It involves identifying opportunities and threats, determining the company's strengths and weaknesses, and then establishing a plan of action to achieve the company's goals.

Some common steps in setting strategic direction include:

- Conducting market research and competitive analysis to identify opportunities and threats

- Assessing the company's current strengths and weaknesses, including internal processes, products and services, and personnel

- Setting clear goal and objectives that make parallel with the company's overall undertaking and visualization

- Developing strategy and tactics to achieve those goals, such as expanding into new markets, investing in R&D, or improving operational efficiency

- Identifying potential risks and developing contingency plans to address them

- Using Data and Analysis to produce Key Performance Measures (Mihaiu, et.al 2021).

Once the strategic direction has been established, companies employ data and analysis to create key performance method that can be used to check the efficiency of the approach implement. These measures are often called KPIs (Key Performance Indicators). Some common steps in creating KPIs include:

- Identifying the most important metrics to track progress towards strategic goals and objectives

- Defining the desired outcomes and setting benchmarks for each metric

- Implementing data collection methods to track the metrics over time

- Analyzing the data to identify trends and areas where improvement is needed

- Communicating the results to key stakeholders and using them to inform decision-making and adjust the strategy as needed

Examples of KPIs that companies might use include:

- Sales revenue

- Market share

- Customer satisfaction ratings

- Employee engagement

- Inventory turnover

- Return on investment

Overall, setting strategic direction and creating key performance measures are critical components of a company's overall strategy. By using data and analysis to inform decision-making and track progress towards strategic goals, companies can ensure that they are on track to achieve their desired outcomes (Paul, et.al 2021).

Hikma’s current strategic position can also be analysed through its financial performance which is discussed through the following points discussed below:

Financial performance

- Main working profit is up 11 percent, focussed by tough progress in the income of Injectables and generics.

- Continued deal in research and growth of 6 percent of profits, with an increasing channel of intricate products.

- Healthy annual report, with net arrears of $605mn and short influence at 0.9x net arrears to main EBITDA (Altaee, 2020).

|

Core outcome (underlying) $ million |

2020 |

2019 |

Change |

Continue currency Change |

|

Core profit |

2,341 |

2,203 |

6% |

6% |

|

Core operating revenue |

566 |

508 |

11% |

17% |

|

Core revenue chargeable to investors |

408 |

364 |

12% |

20% |

|

Main primary earnings per share (cents)3 |

172.9 |

150.4 |

15% |

23% |

|

Reported outcomes (statutory) $ million |

2020 |

2019 |

Change |

Constant money Change |

|

Profits |

2,341 |

2,207 |

6% |

6% |

|

Operating income |

579 |

493 |

17% |

23% |

|

Profit chargeable to stakeholders |

431 |

486 |

(11)% |

(5)% |

|

Cash flow from working activities |

464 |

472 |

(2)% |

- |

|

Normal earnings per share (cents) |

182.6 |

200.8 |

(9)% |

(3)% |

|

Total cash per share (cents)3 |

50.0 |

44.0 |

14% |

- |

The future of organisation by considering the impact that Emerging technologies

As the Strategy Development Manager of Hikma Pharmaceutical, one emerging technology that could have a significant impact on the organization's operations is blockchain technology. Blockchain technology is decentralized, digital ledgers that enable protected and translucent business among party not including the need for mediators. The technology has the potential to streamline supply chain processes, reduce costs, and improve data security and privacy (Bogdan and Dombrowski, 2019).

Impact of Blockchain Technology on Hikma Pharmaceutical:

- Supply Chain Management: Blockchain technology can enable Hikma Pharmaceutical to have end-to-end visibility into its supply chain processes, including the sourcing of raw materials, production, distribution, and sales. By using blockchain technology, Hikma can create a secure, tamper-proof record of all transactions, which can improve the transparency, traceability, and accountability of its supply chain operations.

- Clinical Trials: Blockchain technology can also enhance the efficiency and accuracy of Hikma's clinical trial processes. By using blockchain technology, Hikma can create a secure, decentralized record of all clinical trial data, which can improve the transparency, traceability, and security of clinical trial results. This can increase the reliability and accuracy of the data, which can reduce the time and costs associated with clinical trials.

- Drug Traceability: Blockchain technology can enable Hikma Pharmaceutical to ensure the authenticity and safety of its drugs. By using blockchain technology, Hikma can create a secure, tamper-proof record of all drugs, which can improve the traceability and accountability of its products. This can reduce the risk of counterfeit drugs, which can improve patient safety and increase customer trust.

- Data Security: Blockchain technology can also enhance the security and privacy of Hikma's data. By using blockchain technology, Hikma can create a secure, decentralized record of all data, which can reduce the risk of data breaches and cyber-attacks. This can improve the security and privacy of patient data, which can enhance customer trust and loyalty.

The implementation of blockchain technology can have a significant impact on Hikma Pharmaceutical's operations, improving supply chain management, clinical trials, drug traceability, and data security (Umar, et.al 2022). However, it is important to note that the implementation of blockchain technology will require significant investment and resources, and it may take time to realize the full benefits of the technology. Therefore, careful planning and evaluation are necessary to ensure a successful implementation of blockchain technology.

Conclusion

Based on the analyses above, it is evident that Hikma Pharmaceuticals is a well-established global pharmaceutical company with a strong focus on innovation, quality, and corporate social responsibility. The company has a diversified product portfolio and operates through three business segments, ly Injectables, Generics, and Branded. In terms of the company's current strategic position, it has a strong market presence in over 50 countries worldwide and is well-positioned to leverage emerging technologies such as blockchain to enhance its supply chain management, clinical trials, drug traceability, and data security. However, the implementation of blockchain technology will require significant investment and resources, and careful planning and evaluation are necessary to ensure a successful implementation.

Furthermore, the pharmaceutical industry is highly competitive, and Hikma Pharmaceuticals must continue to focus on innovation, quality, and efficiency to remain competitive and ensure long-term profitability. The company's commitment to corporate social responsibility is also crucial in enhancing its reputation and building customer trust and loyalty. The Hikma Pharmaceuticals has a strong foundation and is well-positioned to continue its growth and success in the global pharmaceutical industry. However, continuous evaluation and adaptation to market trends and emerging technologies are necessary to maintain its competitive edge and ensure long-term sustainability.

References

Abdelhadi, Hamzeh, Mohi-Adden Yahya Al-Qutop, and Nidal Al-Salhi, 2022."The moderating effect of environmental turbulence on the relationship between strategic agility and innovation: a field study in Jordanian pharmaceutical manufacturing companies." International Journal of Agile Systems and Management 15, no. 3 (2022): 243-256.

Adwan, Y.M. and Al-Hamshari, R., 2021. Organizational Mission Impact on Achieving Competitive Advantage in Jordanian Pharmaceutical Sector.

Al, Z.M. and Al Riyals, J.A., 2019.The Impact of Strategic Success on Organizational Health, An Applied Study, Al-Hikma Pharmaceutical Company.

Al-Douri, Z.M., Muttlak, A.L.R.Z. and Al Riyalat, J.A., 2022. The Impact of Strategic Success on Organizational Health, An Applied Study, Al-Hikma Pharmaceutical Company. Bilad Alrafidain Journal of Humanities and Social Science, 3(1).

Alsawalhah, A.A., 2020. Organizational Integration and its Impact on the Effectiveness of Operational Processes (A Case Study on Hikma Pharmaceuticals). Modern Applied Science, 14(7), pp.1-26.

Altaee, M.A.H., 2020. THE ROLE OF STRATEGIC INFORMATION SYSTEMS IN BUILDING STRATEGIC ALLIANCES: APPLICATION TO AL-HIKMA PHARMACEUTICALS COMPANY. Academy of Strategic Management Journal, 19(2), pp.1-11.

Al-Zoubi, M.O., Alrowwad, A.A. and Masa’deh, R.E., 2020. Exploring the relationships among tacit knowledge sharing, mentoring and employees’ abilities: The case of Al-Hikma pharmaceutical company in Jordan. VINE Journal of Information and Knowledge Management Systems, 50(1), pp.34-56.

Bogdan, A.R. and Dombrowski, A.W., 2019. Emerging trends in flow chemistry and applications to the pharmaceutical industry. Journal of medicinal chemistry, 62(14), pp.6422-6468.

Desai, C., 2019. Strategy and strategic management. In Management for Scientists. Emerald Publishing Limited.

Jandhyala, R., 2020. Influence of pharmaceutical company engagement activities on the decision to prescribe: a pilot survey of UK Rare Disease Medicine Prescribers. Pharmaceutical Medicine, 34, pp.127-134.

Kolsi, M.C., Ananzeh, M. and Awawdeh, A., 2021. Compliance with the global reporting initiative standards in Jordan: a case study of hikma pharmaceuticals. International Journal of Sustainable Engineering, 14(6), pp.1572-1586.

Mihaiu, D.M., Șerban, R.A., Opreana, A., Țichindelean, M., Brătian, V. and Barbu, L., 2021. The Impact of Mergers and Acquisitions and Sustainability on Company Performance in the Pharmaceutical Sector. Sustainability, 13(12), p.6525.

Paksoy, T., Gunduz, M.A. and Demir, S., 2019. Overall Competitiveness Efficiency: A Quantitative Approach to the Five Forces Model. Available at SSRN 4374824.

Paul, D., Sanap, G., Shenoy, S., Kalyane, D., Kalia, K. and Tekade, R.K., 2021. Artificial intelligence in drug discovery and development. Drug discovery today, 26(1), p.80.

Skiadas, I., 2020. The changing business model of the Pharmaceutical Industry and its prospects.

Umar, M., Khan, S.A.R., Zia-ul-haq, H.M., Yusliza, M.Y. and Farooq, K., 2022. The role of emerging technologies in implementing green practices to achieve sustainable operations. The TQM Journal, 34(2), pp.232-249.

Go Through the Best and FREE Case Studies Written by Our Academic Experts!

Native Assignment Help. (2026). Retrieved from:

https://www.nativeassignmenthelp.co.uk/hikma-pharmaceuticals-business-strategy-and-competitive-analysis-case-study-23271

Native Assignment Help, (2026),

https://www.nativeassignmenthelp.co.uk/hikma-pharmaceuticals-business-strategy-and-competitive-analysis-case-study-23271

Native Assignment Help (2026) [Online]. Retrieved from:

https://www.nativeassignmenthelp.co.uk/hikma-pharmaceuticals-business-strategy-and-competitive-analysis-case-study-23271

Native Assignment Help. (Native Assignment Help, 2026)

https://www.nativeassignmenthelp.co.uk/hikma-pharmaceuticals-business-strategy-and-competitive-analysis-case-study-23271

- FreeDownload - 1148 TimesRelationship Marketing and Market Segmentation: A Case Study of Uber

Introduction Get free samples written by our Top-Notch subject experts for...View or download

- FreeDownload - 713 TimesHomelessness Crisis in the UK: A Reflective Study on Causes, Challenges, and Policies Case Study

Homelessness Crisis in the UK: A Reflective Study on Causes, Challenges, and...View or download

- FreeDownload - 885 TimesTesco's Procurement Strategy: TQM & Digital Solutions Case Study

Introduction The term procurement strategy refers to a long-term plan...View or download

- FreeDownload - 779 TimesExploring Babylon Health's Innovative AI-Powered Digital Healthcare Solutions Case Study

Exploring Babylon Health's Innovative AI-Powered Digital Healthcare...View or download

- FreeDownload - 2003 TimesStrategic Leadership Alibaba Group Case Study

Strategic Leadership Alibaba group case study Sample Get free samples written...View or download

- FreeDownload - 1011 TimesInnocent Drinks: A Business Economics Case Study

Introduction - Analyzing Innocent's Marketing & Coca-Cola Deal The...View or download

-

100% Confidential

Your personal details and order information are kept completely private with our strict confidentiality policy.

-

On-Time Delivery

Receive your assignment exactly within the promised deadline—no delays, ever.

-

Native British Writers

Get your work crafted by highly-skilled native UK writers with strong academic expertise.

-

A+ Quality Assignments

We deliver top-notch, well-researched, and perfectly structured assignments to help you secure the highest grades.